Wheel Options Strategy: The Complete Step-by-Step Guide (With Real Examples)

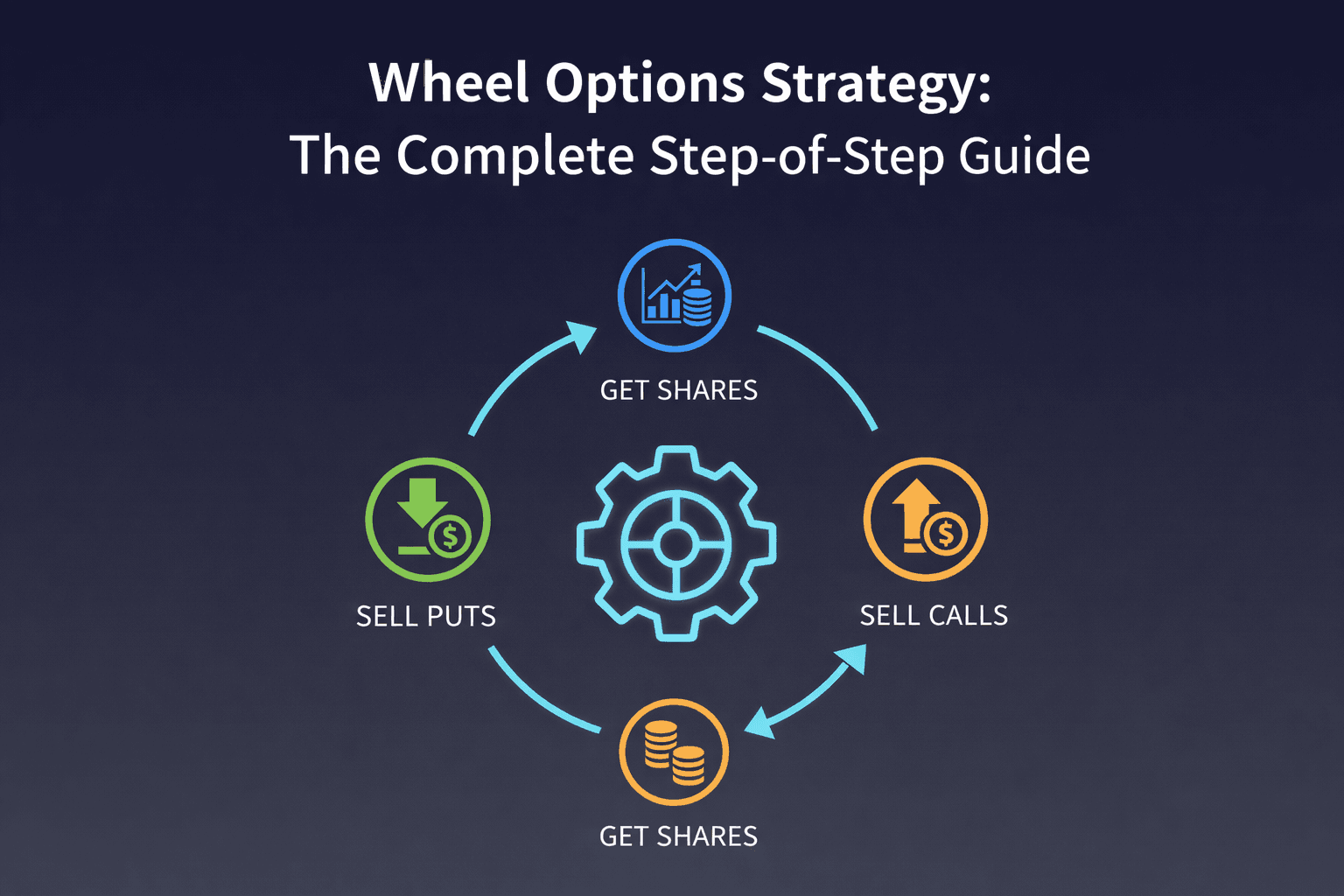

The wheel options strategy is a repeatable process that aims to generate income by:

- selling cash-secured puts on a stock you’re willing to own, then

- if assigned, selling covered calls on the shares until they’re called away (or you exit), then

- repeating the cycle.

This “sell puts → maybe get shares → sell calls → repeat” loop is why it’s called the wheel.

This guide is written for real-world traders who want an actionable workflow—not just theory. It includes:

- a clear step-by-step playbook

- a full example with numbers

- stock selection + strike selection rules

- risk management (the part most wheel articles under-emphasize)

Not investment advice. Options involve risk. The wheel can still lose money—especially when the underlying stock drops.

What is the wheel strategy in options?

The wheel is a multi-step, repeatable options income strategy:

- Sell an out-of-the-money cash-secured put (CSP). If it expires worthless, you keep the premium and can sell another put. If you’re assigned, you buy 100 shares per contract.

- After assignment, sell covered calls against your shares to collect more premium. If the call expires worthless, repeat. If the call is exercised, your shares are sold (called away), and you can go back to selling puts.

Some people call it the “triple income strategy” (premium from puts + premium from calls + dividends), but the core mechanics are the same. Here is a popular Reddit post on this topic.

When the wheel strategy works (and when it doesn’t)

Market conditions where the wheel tends to fit

- Sideways to mildly bullish markets: you can repeatedly collect premium while the stock chops around or trends up slowly.

When it can go wrong

- The biggest risk is simple: the stock drops hard after you sell puts or after you get assigned. Premiums help, but they do not eliminate downside.

- Highly volatile conditions can reduce “smooth” outcomes and force you into tough decisions (hold/roll/close) more often.

The wheel is not a cheat code—it’s a structured way to get paid for taking on the same risk you’d take by owning the stock (plus some path-dependent timing risk).

The wheel strategy, step-by-step (the practical version)

Schwab’s breakdown is one of the cleanest “official” step lists, and it matches how most traders actually run it:

Step 0: Pick a stock you actually want to own

Before you look at premium, answer:

- Would I be happy owning 100 shares at my put strike?

- If the stock drops 20–40%, would I still be okay holding and selling calls?

This is the wheel’s “hidden requirement.” Multiple top guides emphasize that underlying selection matters more than squeezing premium.

Step 1: Sell a cash-secured put (CSP)

- Choose an expiration (many wheel traders use shorter expirations; Schwab notes “six months or less” as typical).

- Pick a strike where you’d be willing to buy shares.

- Collect premium upfront.

Outcome A (ideal): put expires worthless → keep premium → sell another CSP.

Outcome B: you’re assigned → you buy 100 shares per contract at the strike price.

Step 2: If assigned, you now own shares

You’re effectively a stockholder now. Your next decision is how you’ll manage the position:

- hold shares and wait,

- sell covered calls immediately,

- or exit (rare in “pure” wheel, but sometimes rational).

Step 3: Sell a covered call

- Sell an out-of-the-money call against your 100 shares.

- Collect premium.

- Repeat calls until either:

- calls expire worthless (you keep premium), or

- shares are called away (sold at the call strike), or

- you choose to close the position.

Step 4: If called away, go back to Step 1

Once shares are sold, you can restart the wheel by selling a CSP again.

A full wheel example (with clean math)

Let’s keep the numbers simple and focus on the mechanics.

Assume:

- Stock is at $50

- You sell 1 cash-secured put with strike $48

- You collect $1.00 premium ($100 total)

Scenario 1: Put expires worthless

- You keep $100

- Your “wheel” stays in the put-selling phase

- Next cycle: sell another CSP (new strike, new expiration)

Scenario 2: You get assigned

You buy 100 shares at $48 = $4,800.

Now factor in the premium you collected:

- “Effective” entry price (simple way to think): $48.00 – $1.00 = $47.00

Now you sell a covered call:

- Sell call strike $50

- Collect $0.80 ($80)

If the call expires worthless:

- You keep $80 and can sell another call next cycle

- Your premiums continue to reduce your “net cost” over time (conceptually)

If the call is exercised:

- You sell shares at $50

- That’s a $2/share gain vs $48 strike, plus the premiums you collected along the way

Key takeaway: the wheel is basically choosing your buy price with puts and choosing your sell price with calls, and getting paid premiums in the process.

How to choose the best stocks for the wheel

Most wheel guides converge on the same principle:

Don’t chase premium. Pick an underlying you’re comfortable owning.

Alpaca explicitly frames underlying selection as the foundation: choose assets you’re comfortable holding long-term, that fit your capital constraints (100 shares), with steady performance and moderate volatility.

Schwab also stresses being comfortable owning the shares and picking “fundamentally sound stocks” at reasonable strikes.

A practical checklist

Pick stocks/ETFs that generally have:

- Liquid options (tight spreads, good open interest)

- Reasonable price per 100 shares for your account size

- A business you can explain in 2 sentences

- A price level where you’d genuinely be okay owning shares

Avoid:

- meme-level volatility unless you want that ride

- illiquid chains (wide bid/ask spreads quietly eat your edge)

Strike selection: the “limit order” mindset

A clean way to stay disciplined:

- Your CSP strike is basically your limit buy price.

- Your covered call strike is basically your limit sell price.

Here is the trade-off: strikes closer to ITM pay more premium but increase the chance of being exercised; farther OTM reduces exercise risk but also reduces premium.

Using delta as a simple probability proxy (optional)

If you like using delta:

- Delta can be used as an indicator of the probability an option finishes ITM (example: ~0.40 delta ≈ 40% chance).

Practical translation:

- Higher delta → more premium, more assignment likelihood

- Lower delta → less premium, less assignment likelihood

How to track positions delta to know the probability of assignments

Rolling: when (and why) wheel traders roll options

Rolling is common in wheel discussions: you may roll puts to collect additional premium and potentially reduce assignment risk; premiums collected can lower the effective cost basis relative to the strike.

A sensible rolling framework:

- Roll only when it improves your position quality (better strike, more time, more credit) and still matches your “I’m okay owning this stock here” rule.

- Avoid rolling just to “avoid taking the L” if the underlying thesis has broken.

How to track rolling campaign PnL

Risk management (the part that determines your outcome)

The wheel is often marketed as “easy income.” The truth:

- your long-run results are dominated by drawdowns in the underlying and your ability to stick to rules when price falls.

Core risk controls

- Position sizing: don’t let one ticker dominate your account.

- Don’t wheel trash you wouldn’t hold: premium is not a free lunch.

- Have a plan for big drops: will you hold, reduce, hedge, or stop selling calls below your cost basis?

- Know the trade-off you’re accepting: higher premium usually means you’re closer to taking assignment / getting called away.

The wheel strategy workflow (copy/paste checklist)

Use this as your weekly routine:

- Pick underlying: “Would I hold 100 shares for months?”

- Sell CSP: strike = your happy buy price.

- If expires worthless: repeat CSP.

- If assigned: decide covered call plan.

- Sell covered call: strike = your happy sell price.

- If call expires worthless: repeat call.

- If called away: restart CSP wheel.

- Risk check: portfolio concentration + “what if it drops 30%?”

How to track wheel performance (and why most brokers are confusing)

The wheel is multi-leg over time:

- you may sell multiple CSPs before assignment

- you may sell many calls after assignment

- you may roll, close early, or take partial actions

That means tracking “true performance” often requires:

- knowing your effective entry after premiums

- knowing your net P/L across the entire cycle

- separating “stock P/L” from “options premium P/L” cleanly

If you’re using OptionIncome, this is exactly the kind of strategy where a dedicated tracker helps:

- wheel cycles can be grouped and reviewed by ticker/strategy

- you can see realized P/L from closed options

- you can audit how premiums affected your net outcome over time

Read more on how we help your wheel strategy

FAQ

What is the wheel strategy options?

It’s a repeatable options income approach: sell cash-secured puts; if assigned, sell covered calls; if called away, repeat.

What is wheel strategy in options trading?

Same concept: using puts to potentially acquire shares at a chosen price, then using covered calls to generate income while holding shares.

Is the options wheel strategy profitable?

It can be, but it’s not guaranteed. The strategy collects premium and can reduce effective cost basis over time, but it does not eliminate downside risk from stock ownership (big stock drops can overwhelm premium).

What is the biggest risk of the wheel?

A sharp decline in the underlying stock price. Multiple reputable guides emphasize the downside risk and the need to be comfortable owning the stock.

Do I need a margin account for the wheel?

Not necessarily. A classic wheel uses cash-secured puts (cash set aside to buy shares if assigned) and covered calls (calls covered by owned shares).

Related reading

- What Is a Covered Call? Complete Guide for Income Investors

- What is a Cash-Secured Put? Complete Guide for Income Investors

- Options Trading Journal: 7 Income Mistakes That Prove Why You Need One

Summary

The wheel options strategy is simple in structure but not effortless:

- Sell CSPs on stocks you want to own

- If assigned, sell covered calls

- Manage risk like a stock investor (because you are one once assigned)

- Track the full cycle, not just one option leg

If you want wheel content that ranks, the difference-maker is not another generic definition—it’s giving readers a repeatable workflow, real examples, and clear risk rules they can actually follow.