Wheel Strategy Reduced Cost Basis

If you run the wheel strategy, you’ve probably wondered what your true cost basis is after multiple put assignments and covered call premiums.

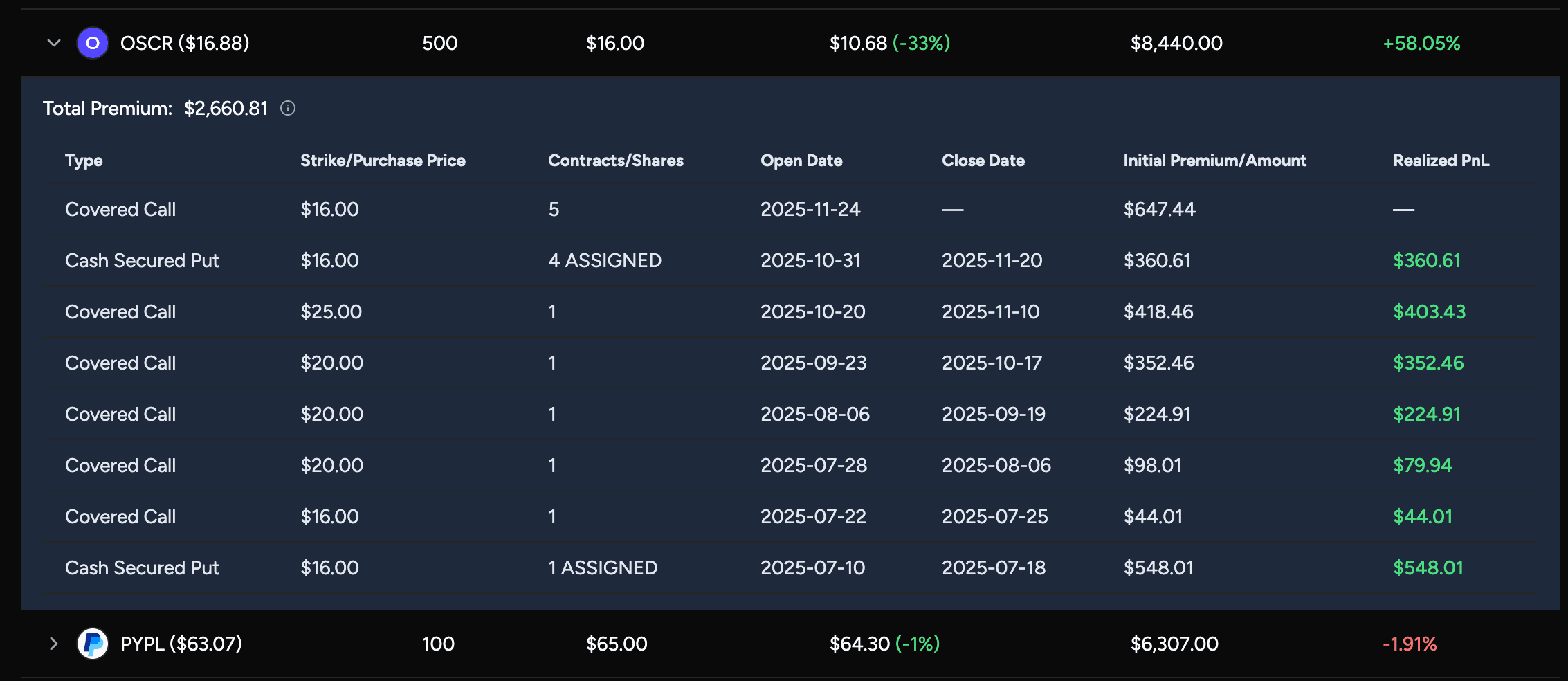

When you sell a short put, get assigned, and continue selling covered calls, the premium you collect over time reduces your effective stock cost. Brokers usually show trades in isolation, making it hard to see the real picture.

How OptionIncome helps

Go to Equity Positions and enable the Wheel Strategy view.

OptionIncome automatically groups all related wheel trades into a single strategy campaign. You’ll see assigned short puts, covered call premium, and an adjusted cost basis that reflects all collected premium.

Use this adjusted cost basis to decide when you’re comfortable selling the shares and locking in profit.

Last updated on