Identify Early Assignment Risk

Early assignment often happens when short options move deep in the money and have little to no time value left. OptionIncome helps you spot these situations early so you can take action before assignment occurs.

How OptionIncome helps

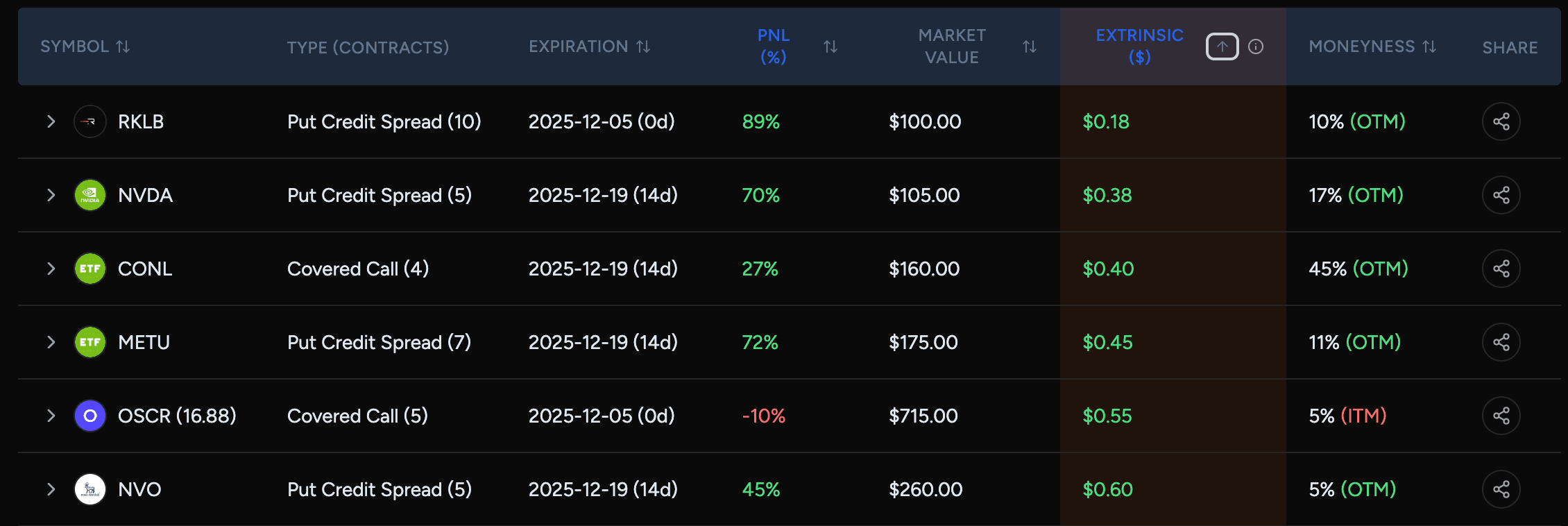

In the Live Positions panel, you can sort and filter positions to quickly surface assignment risk:

- In-the-money (ITM): instantly see which short options are already ITM and require attention.

- Expiration date: focus on positions entering the final week before expiration.

- Delta: identify deep ITM options, where higher delta (around 80% or above near expiration) signals increased assignment risk.

- Extrinsic value: toggle the delta column to spot options with very little remaining time value.

When extrinsic value approaches zero, the option holder has little incentive to wait, increasing the likelihood of early assignment.

When to take action

Combining these signals helps you identify positions that may need to be closed, rolled, or adjusted before assignment becomes a problem.

Last updated on